Online fraud includes financial fraud and identity theft on digital channels, such as websites and mobile apps. The amount of money lost to online fraud continues to rise, accelerated by enterprises unprepared for the sudden shift from brick-and-mortar transactions to online engagements during the pandemic. Javelin Strategy & Research reported that consumers lost $56 billion to identity fraud in 2020. Juniper Research projected eCommerce losses due to online payment fraud could exceed $20 billion in 2021.

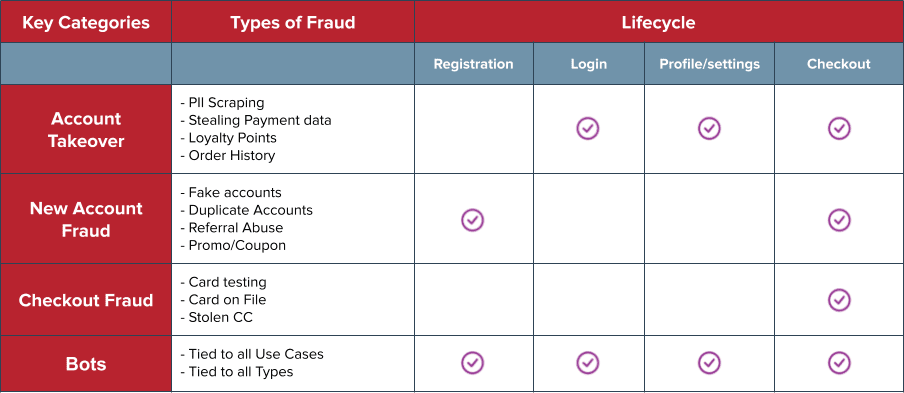

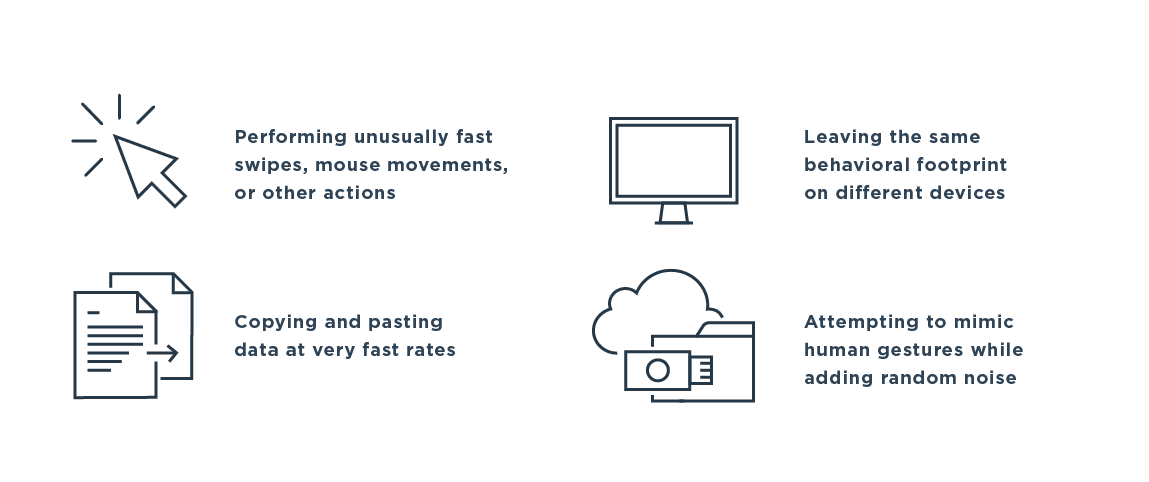

Online fraud can occur at any stage of the user journey, not just at checkout. Unlike real customers who spend time browsing or searching for what they need, bots and fraudsters work quickly and directly to complete their fraudulent activity. Monitoring and early detection reduce the number of fraud incidents and the overall cost of fraud.

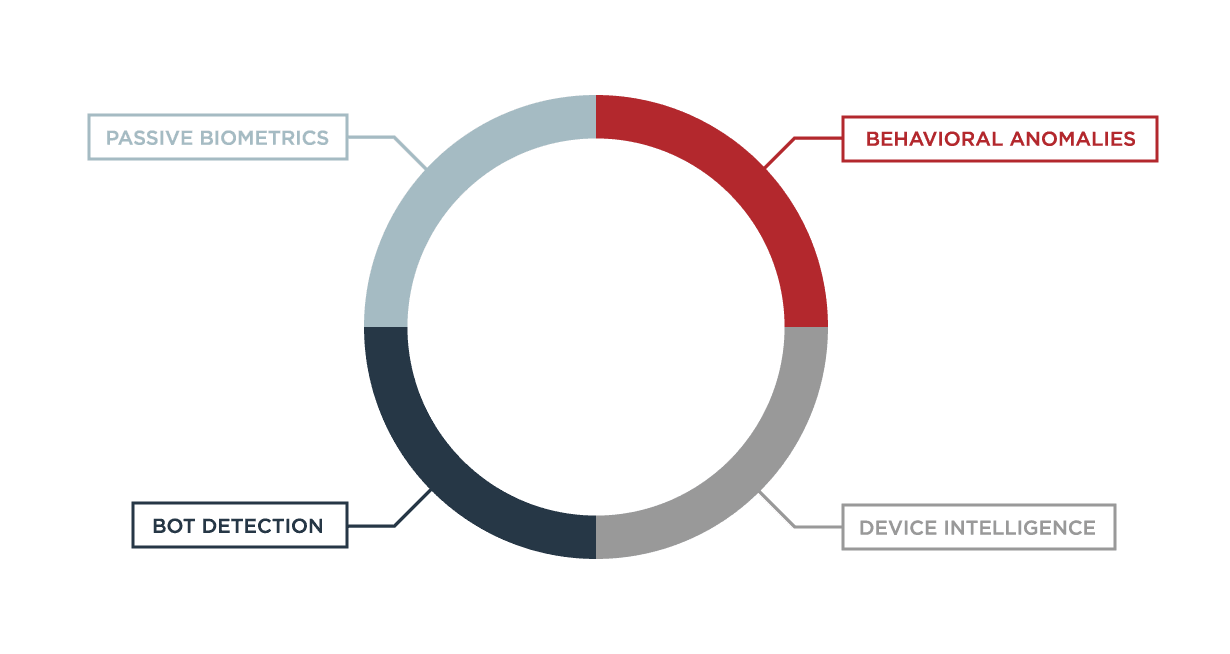

Read on to learn about different types of online fraud and ways to detect, monitor and prevent bad actors from scamming your enterprise.