The State of Cloud Adoption in Financial Services

When it comes to digital transformation initiatives, cloud computing is frequently a key part of the conversation. The cloud is meant to be cost-effective, flexible, and scalable – a way to optimize operations, improve efficiency, and address a long list of use cases. And yet, technology professionals will be quick to caution that cloud services are not a panacea for every business challenge, and cloud transformation may look very different across different types of companies.

For example, while some industries embraced cloud migration early on, financial institutions have always moved at their own pace. The financial services sector has some of the most complex legacy application ecosystems and must comply with strict regulations, which has resulted in hesitance when it comes to embracing public cloud. On-premise systems were the norm, and initial exploration of the cloud was largely limited to private cloud deployments as financial institutions took a more conservative approach. However, the promise of offering better services with less effort has driven banks, credit unions, and other financial organizations to explore other types of cloud environments. In recent years, financial organizations have been investing much more in hybrid deployment models and public cloud, with 90% using at least two cloud deployment types and 88% using more than one public cloud. 64% of enterprises that have adopted public or internal private cloud even consider public cloud as their primary cloud platform.1

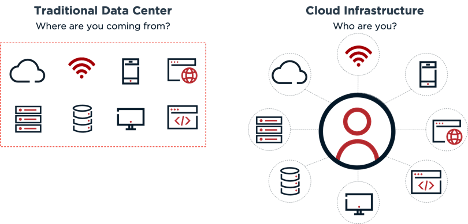

Clearly, the cloud has become integral to the way modern financial institutions do business. However, the cloud journey still presents financial institutions with unique challenges around security and privacy which must be addressed. Finding the right cloud deployment model is critical to long-term business success – and identity tools can help financial institutions get the most out of their cloud investments.