Here are some highlights from a case study on a nationwide health insurance provider to give you an idea of what a CIAM solution can do for your insurance company.

- Scale and performance handles more than 70 million users at once.

- The solution integrates seamlessly with state healthcare exchanges.

- Siloed data is eliminated through centralized identity management.

- The company reduces breach risk and increases regulation compliance.

Insurance providers who rely on partner relationships have an added layer of complexity when securing partner access. These partners need access to enterprise apps to fulfill their roles, which can be burdensome and leave your data vulnerable. An IAM solution can be tailored for your organization.

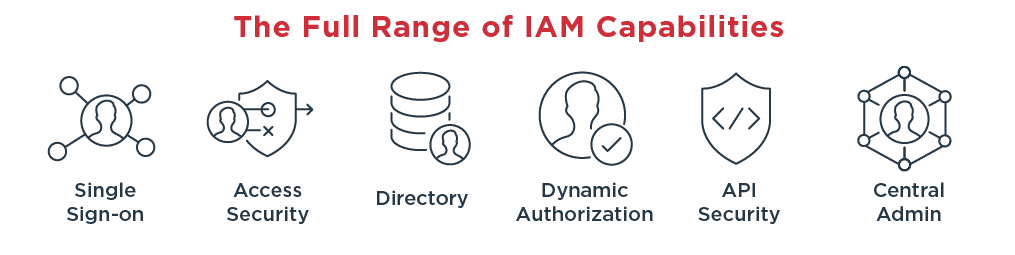

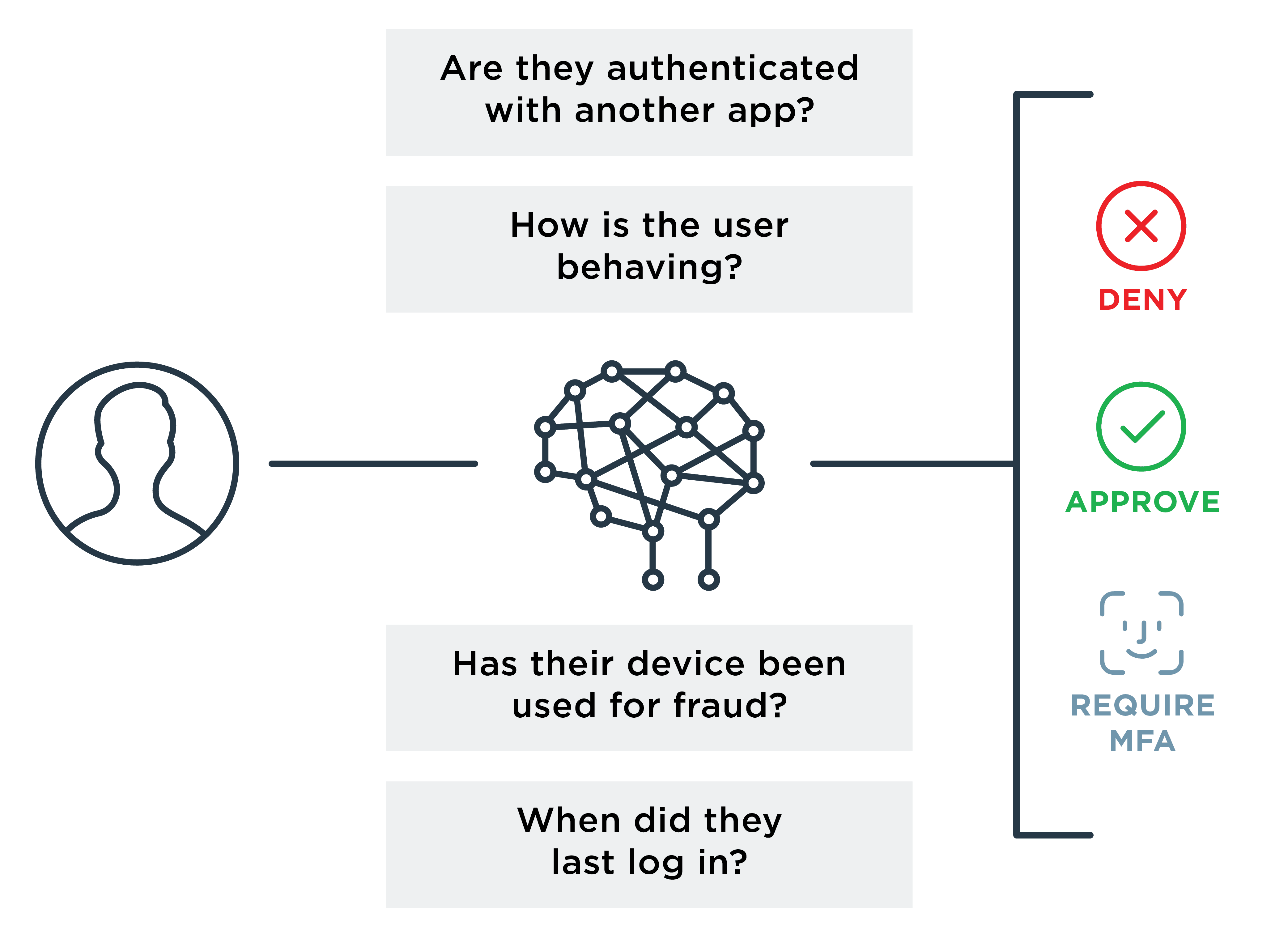

Support on your digital transformation journey. If you have complex, hybrid IT environments, IAM can help you modernize and improve your operations. Find an IAM solution that can integrate with your legacy single sign-on (SSO), web access management (WAM), multi-factor authentication (MFA), directories and more.

Reduce the burden on the corporate IT department. Allow subsidiaries and partners to manage their own employees and/or customers, such as adding, deleting and updating their information. You can still retain control over provisioning administrators, which reduces the risk that a person no longer employed by a partner can access your system.

Regulatory compliance. Regulations typically address strong authentication, storing customer data, maintaining consent records and securing access. For health insurance companies, those regulations can include the Health Insurance Portability and Accountability Act (HIPAA) and the 21st Century Cures Act.

Streamline customer onboarding and personalization. Identity orchestration allows you to provide customers with a seamless experience when they register, request quotes, select authentication methods, update their accounts and throughout their customer journey. Collect data securely to keep track of customer milestones, like marriages and births, to identify opportunities for new insurance needs.

To learn more about the importance of the customer experience for insurance companies, please read our eBook.