Introduction

Customer and employee preferences shifted during the pandemic. Remote work, online shopping, banking, and other activities are here to stay. Bad actors view the increased online activity as a huge opportunity because they are no longer stopped by on-premises boundaries. Organizations’ attack surfaces have grown with an increase in apps, APIs, and SaaS services, so there’s a need to defend resources from attacks on multiple fronts.

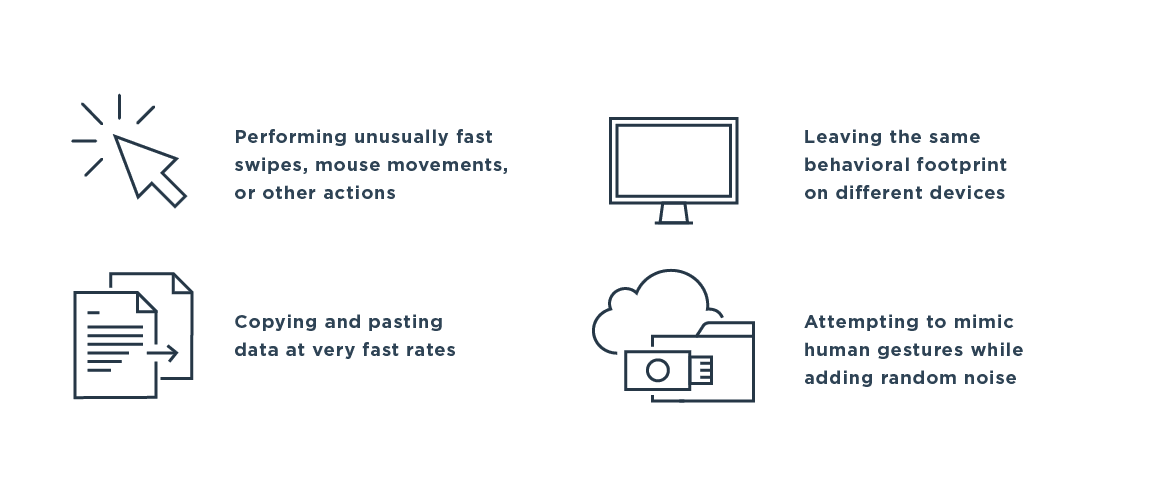

Enterprises need to adapt to allow legitimate users secure access to the resources they need from any location at any time on any device without causing them to jump through too many hoops. A modern fraud mitigation strategy looks at user behavior and device signals throughout the user journey in real time, with minimal disruption to legitimate users. Fraudulent transactions can be stopped before they cost your company money and brand damage. LexisNexis found that in 2021, every $1 of fraud cost U.S. retail and eCommerce merchants $3.60 and in Canada the cost was $3.02.

Online fraud takes many forms, including account takeover (ATO) fraud, new account fraud, checkout fraud and business email compromise (BEC), which was the costliest form of fraud in 2020, accounting for $1.8 billion in losses. Identity proofing, access management, and fraud detection work hand-in-hand to provide users with a seamless experience while defending against multiple attack vectors. Let’s look at each component individually and how they work together as a holistic solution.